Many advisors prioritize sales over problem-solving. However, clients detect when advisors care more about commissions than comprehending needs. This erodes trust quickly.

Without holistically understanding clients’ circumstances, advisors risk proposing unsuitable solutions and ignoring unique goals. Generic proposals frustrate clients expecting personalized guidance.

An overly sales-focused advisor often loses accounts after the initial sale. Churning through clients by pushily selling commodities shrivels client retention rates.

Short-term commission boosts mean less than earning enduring client loyalty. Advisors seeking quick sales over long-term relationships destroy trust and referral potential.

Thoughtfully listening to itself provides immense value. Ask probing questions to fully grasp clients’ situations, problems, goals, values, and constraints.

Listening intently signals an advisor to see the whole client, not just a sales target. When an advisor invests time in understanding perspectives, trust grows.

By elevating advice over quick sales, an advisor becomes a trusted partner rather than a typical salesperson. Comprehensive financial plans take shape through first listening.

Many clients have never felt truly heard by financial professionals before. Advisors can differentiate by making individuals feel uniquely understood.

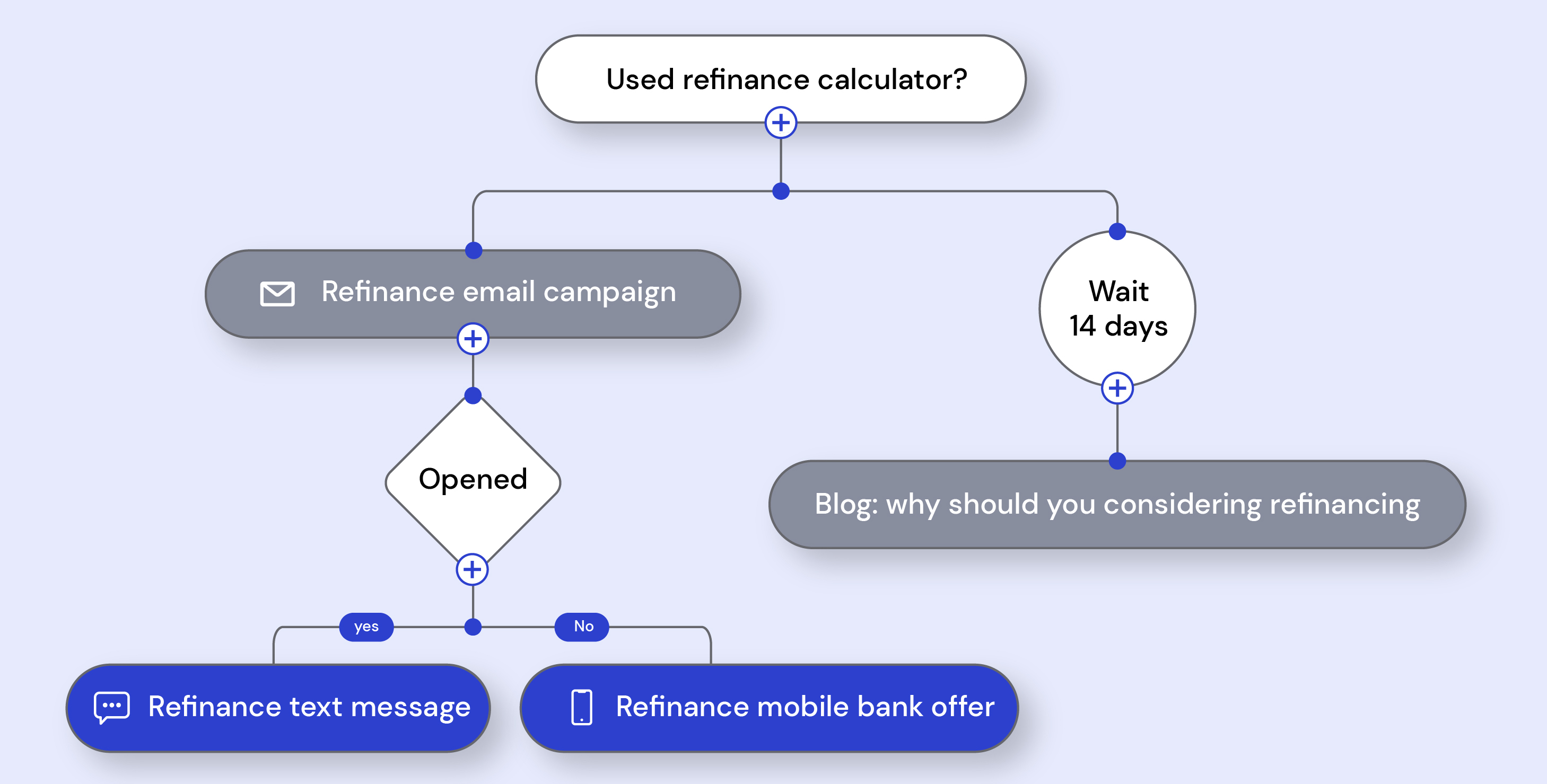

With robust understanding, advisors can create tailored plans aligned to needs and objectives using financial planning techniques like:

With nuanced understanding, advisors create tailored plans addressing individual needs and objectives. Generic proposals disappoint clients expecting personalized guidance.

Advisors educate and engage meaningfully when grasping nuanced situations. Customized recommendations outperform vague generalizations.

By solving problems over-pushing products, advisors transform into experts. They provide client-centric financial guidance rather than sales pitches.

Bespoke plans addressing specific concerns foster tremendous goodwill. Thoughtful solutions build loyalty better than any investment product alone could.

Investing upfront in listening attentively to grasp clients’ situations fosters durable relationships.

Trust and rapport bloom over time through upfront care.

Advisors become trusted partners for navigating all major financial decisions rather than vendors selling commodities. They earn irreplaceable seats at the table.

Loyal clients refer others and generate sustainable organic growth. But quick sales chasing commissions sever promising connections before they mature.

By rushing to sell, an advisor forfeits the chance to cement once-in-a-career roles guiding clients’ financial lives. Lasting rewards come from patience.

Embracing financial planning over quick sales brings tangible benefits, including:

Legacy planning helps secure clients’ long-term financial visions, including transferring wealth across generations. Advisors can provide immense value by reviewing estate documents like wills, trusts, and powers of attorney for completeness and tax optimization.

They can also discuss strategies to efficiently pass on assets while avoiding probate issues, analyze gifting and inheritance tax implications, and guide conversations between aging clients and heirs on legacy intentions.

Additional legacy planning support includes:

Thoughtful legacy planning provides comfort that assets will benefit heirs and causes as intended.

Rather than focusing on investment products, reframe your value by providing ongoing comprehensive financial planning services.

Services include quarterly check-in calls to review changing client situations, annual plan reviews to update strategies over time, ongoing budgeting and cash flow assistance, tax planning and preparation guidance, continued debt payoff and credit optimization advice, routine insurance policy audits to match needs, and regular portfolio rebalancing and performance benchmarks.

Education builds engagement and cements advisor-client relationships. Ongoing teaching opportunities include:

Putting client problems first always benefits advisors and individuals in the long term. Advice builds durable trust and loyalty over salesmanship. Rather than rushing to sell, first seek full understanding. The sales will follow naturally when tailored solutions are provided as a trusted guide.