Touchpoints can span multiple months or even years for financial service customers with offline and online interactions. The siloed nature of service delivery and insular culture within most financial institutions can worsen things.

Understanding the customer journey from the customer’s point of view gives you the magic bullet to improve conversion and customer satisfaction. Customers interact with you with their own goals, and analyzing the customer journey helps you identify the gaps between their goals and your bank’s objective.

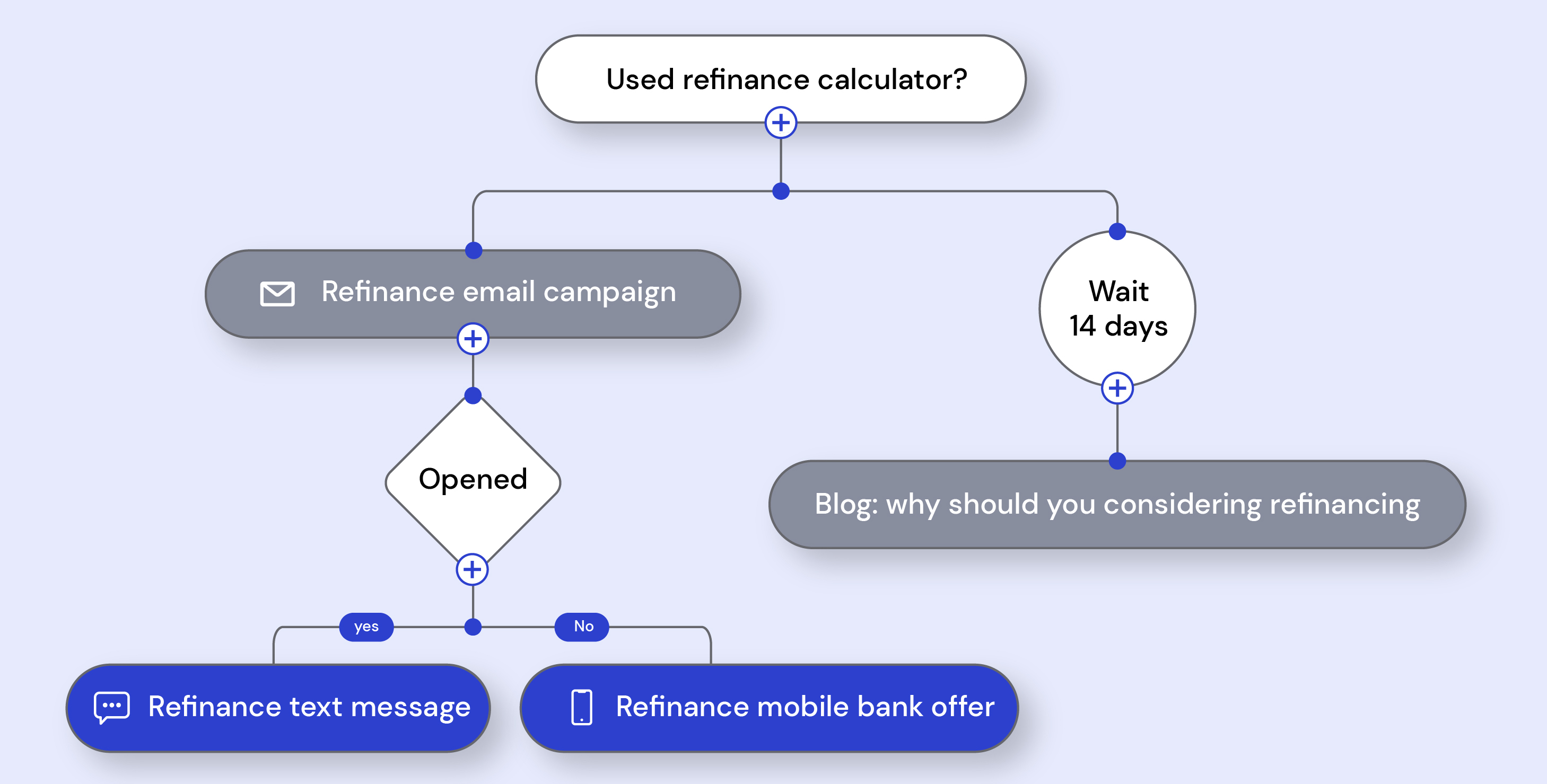

Do you have the right technology platform to support complex engagement workflows across multiple channels?

Schedule a call today to learn how Kapitalwise JourneyBuilder® can help you build, track and analyze customer journies and measure the impact on the bottom line.