The banking industry stands at a critical juncture as we enter 2024. The rapid advancement of artificial intelligence (AI), data analytics, and digital technologies has ushered in an era of unprecedented change. As consumer expectations evolve and digital-native competitors emerge, traditional banks must embrace transformation or risk obsolescence.

The AI Revolution: Redefining Banking

According to Forbes, the rise of AI presents both challenges and opportunities for the banking sector. As Michael Abbott, Senior Managing Director at Accenture, notes, “Gen AI won’t change banking, but it will change how it gets done.”

Banks that harness AI’s potential to streamline operations, enhance risk management, and deliver personalized experiences will gain a significant competitive edge.

However, adopting AI is not without its hurdles. Legacy systems, data silos, and organizational resistance can hinder progress. Banks must prioritize modernizing their infrastructure and fostering a culture of innovation to fully capitalize on AI’s transformative power.

The Data Imperative: Fueling Personalization

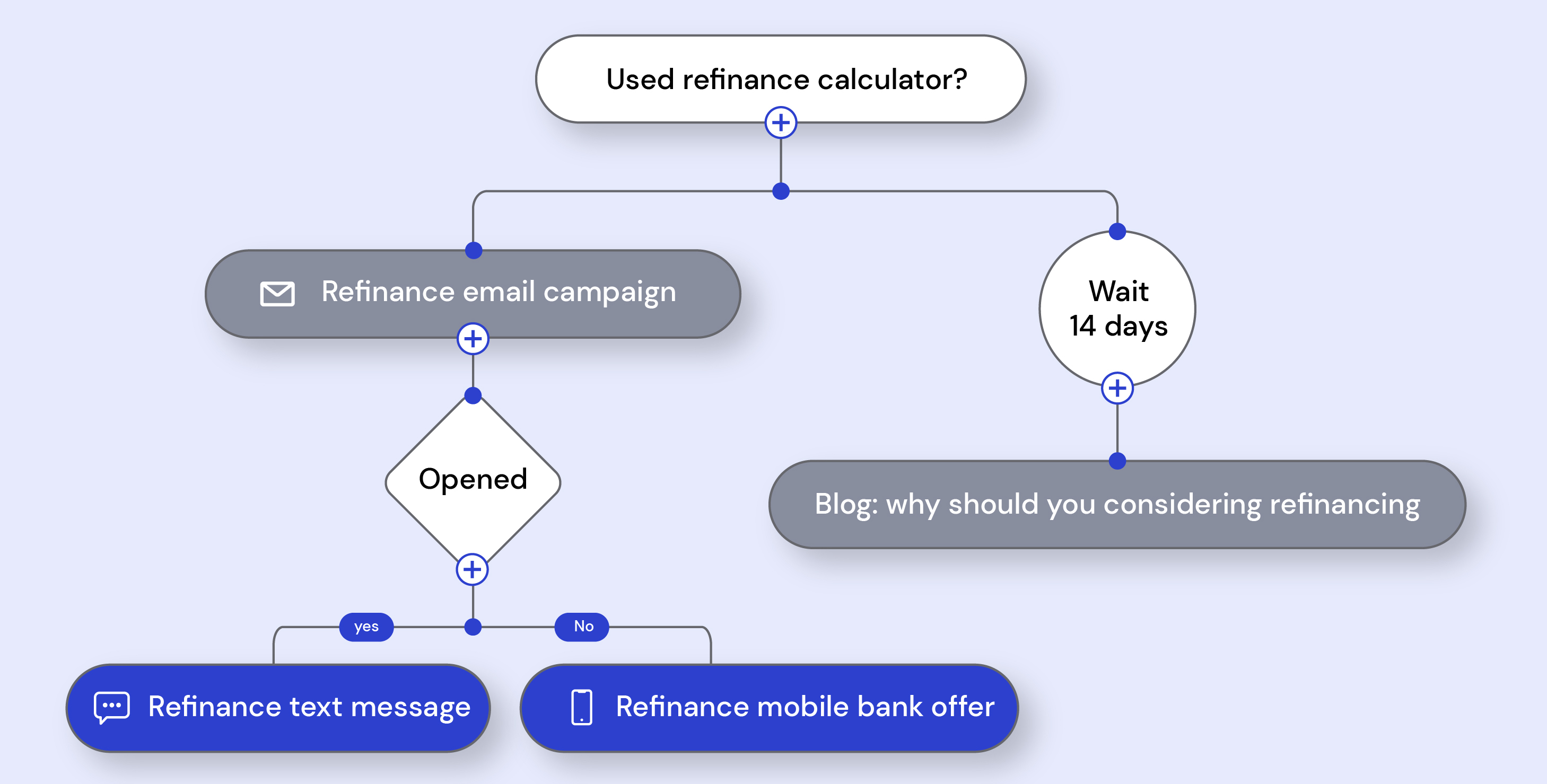

The Financial Brand’s 2024 Retail Banking Trends and Priorities report highlights the growing importance of data and analytics in driving personalized banking experiences. Over half of financial institutions recognize that leveraging customer data is crucial to remaining competitive.

Yet, only 22% list enhancing analytics capabilities as their top priority.

This disconnect between understanding and action is concerning. Banks that fail to invest in robust data management and analytics risk falling behind in the race to deliver hyper-personalized services.

By unifying customer data across touchpoints and applying advanced analytics, banks can gain a holistic view of individual needs and preferences, enabling them to provide tailored recommendations and proactive support.

Embracing Digital Transformation

The digital imperative extends beyond AI and data. As The Financial Brand reports, only 9% of banks globally consider themselves fully digitally mature. The majority are still in the early stages of their digital transformation journeys.

To accelerate progress, banks must adopt a holistic approach that encompasses both technology and culture. This means investing in agile infrastructure, re-engineering processes for efficiency, and fostering a customer-centric mindset across the organization. Collaborating with fintech partners can provide access to cutting-edge solutions and specialized expertise.

Balancing Technology and Human Touch

While digital transformation is essential, banks must balance technology and human interaction. As AI-powered chatbots and self-service options become more prevalent, preserving the human touch is crucial to building trust and emotional customer connections.

Banks should aim to augment, rather than replace, human talent with AI. Banks can empower their employees to focus on high-value, relationship-building activities by leveraging AI to automate routine tasks and provide data-driven insights. This hybrid approach ensures that customers receive the benefits of both technology and human expertise.

Navigating Regulatory Challenges

As AI and digital technologies reshape the banking landscape, regulatory frameworks must adapt to ensure consumer protection and financial stability. Forbes highlights the need for banks and regulators to collaborate in finding the right balance between innovation and oversight.

Banks must prioritize compliance and risk management as they integrate AI and digital solutions. This includes implementing robust governance frameworks, conducting thorough testing, and maintaining transparency around AI decision-making processes.

Proactively engaging with regulators can help banks navigate evolving regulatory requirements and build trust with customers and stakeholders.

2024 & Beyond

The future of banking belongs to those who embrace the digital imperative. As we move further into 2024, banks that prioritize AI adoption, data-driven personalization, and end-to-end digital transformation will be well-positioned to thrive in an increasingly competitive landscape.

However, technology alone is not enough. Banks must also cultivate a customer-centric culture, invest in talent development, and maintain a human touch in the age of AI. By striking the right balance between innovation and empathy, banks can build lasting relationships with customers and secure their place in the future of finance.

The road ahead may be challenging, but the rewards are immense. Banks that act decisively and adapt to the changing landscape will not only survive but flourish in the years to come. The digital imperative is clear – it’s time for banks to embrace it with open arms.