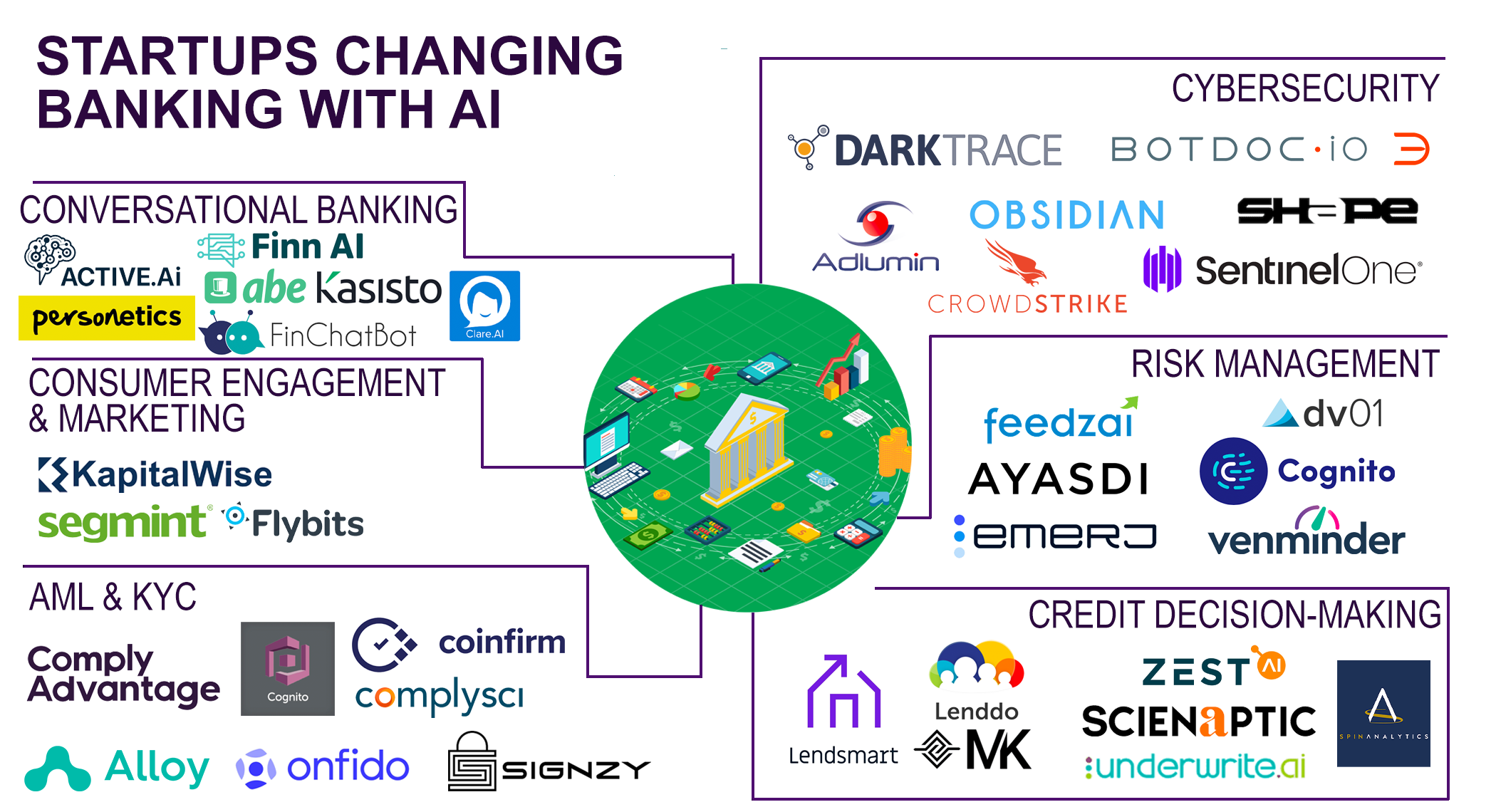

Artificial intelligence in the banking and finance sector has given customers a completely new outlook on banking. Customer demands for a safe, digital platform where they can access, save and invest their money has been met. As the opportunities for big data and machine learning continue to expand, today we’ll touch on which sectors of banking have been actively using artificial intelligence.

Consumer Engagement and Marketing

Artificial intelligence that is most visible to the public is found in the personalized banking sector. With today’s tech-savvy consumers, a digital platform for banking is a must.

Artificial intelligence software uses consumer data to offer personalized products, reach out at the right time, and provide assistance with machine learning. Consumer engagement software companies specialize in creating platforms for financial institutions that help establish relationships with their customers. These personalization platforms are helping banks to build insights out of large amounts of data to serve their customers with the right product and service at the right time.

Conversational Banking/Chat Bots

The most common implementation we see today are chatbots, a computer program that stimulates conversation like a customer support specialist would. Chatbots cut down costs to have a live customer support team, let customers reach out 24 hours a day, and creates more standardized responses.

Companies that create chatbots occasionally face customers that are hesitant to use the website’s chatbot features. The younger, tech-savvy generation prefers chatbots over real people– however, the idea may seem unusual for users not as familiar with recent technology.

KYC/AML

Artificial intelligence is changing the way banks perform customer on-boarding, fighting financial crime, meetingg the ongoing regulatory, and compliance requirements. With new technologies creating more loop-holes and cross-border transactions, it isn’t getting any easier.

Financial institutions are beginning to automate KYC procedures with artificial intelligence because it is not only effective but also time and cost-efficient. Artificial intelligence uses machine learning and big data to manage large volumes of customer profiles, automate tasks that are prone to human error, and help firms manage their risk profiles.

Cybersecurity

Similar to money-laundering, cybersecurity also has privacy concerns due to emerging technologies. According to Capgemini, 42% of the companies involved in their research have noticed rising security breaches. On top of this report, 2/3 of companies have planned to adopt AI solutions by 2020.

Companies that have experienced security breaches are at risk of having compromised information such as email addresses, passwords, and personal data. Cyber attacks gain access to social security numbers, credit card numbers, and various other information. Artificial intelligence can be used to detect threats and prevent serious harm.

Credit decision-making

Millennials and Gen Z consumers hold the majority in card ownership. As younger people start applying for credit cards and filling out loan applications, less card history is known for crucial credit decision-making.

Having good credit is decisive when it comes to financing oneself. In order to see if a borrower’s loan application should be approved, companies check their credit history. In times like these when credit history is more important than ever, artificial intelligence solutions help financial institutions with underwriting decisions. These AI-driven decisions help assess traditionally undeserved borrowers that have little to no credit history, such as millennials and Gen Z customers, in a credit decision-making process.

Risk management

Financial institutions are turning towards machine learning to create more precise, nimble models. Programmers use existing data to predict various factors: finding trends, identifying risk, and conserving manpower. Accurate predictions for managing risk are essential to protecting businesses.

Artificial intelligence softwares also help financial institutions combat money-laundering detections. A significant chunk of time is saved for these institutions as money-laundering investigations are lengthy and strenuous. Companies such as Ayasadi create AML solutions that help combat investigation time.