Customer acquisition is a winning deal for banks and credit unions. But, is it all about the acquisition, or are we just paying more attention to a fraction of the process? What about the ones who already exist? Are they going unnoticed contributing to a silent attrition hike?

“Silent attrition for financial institutions is when a customer stops their alliance with the bank without formally ending their relationship. i.e. they leave little to no balance in their account, but also don’t close them.”

Customer churn that could have been avoided is said to cost U.S. businesses $136 billion a year.

Financial institutions have been prioritizing reducing customer churn rates for quite some time with little to no improvement in the process. Here’s a quick read of how AI can help predict and prevent silent attrition of our valuable customers.

Predictive Analytics for Silent Customer Attrition

Customer needs keep shifting and it’s very difficult for humans to evaluate the needs of different minds. Advanced analytics and data mining assessments can be used to study consumer behavior patterns based on past, present and future financial institutions to customer relationships.

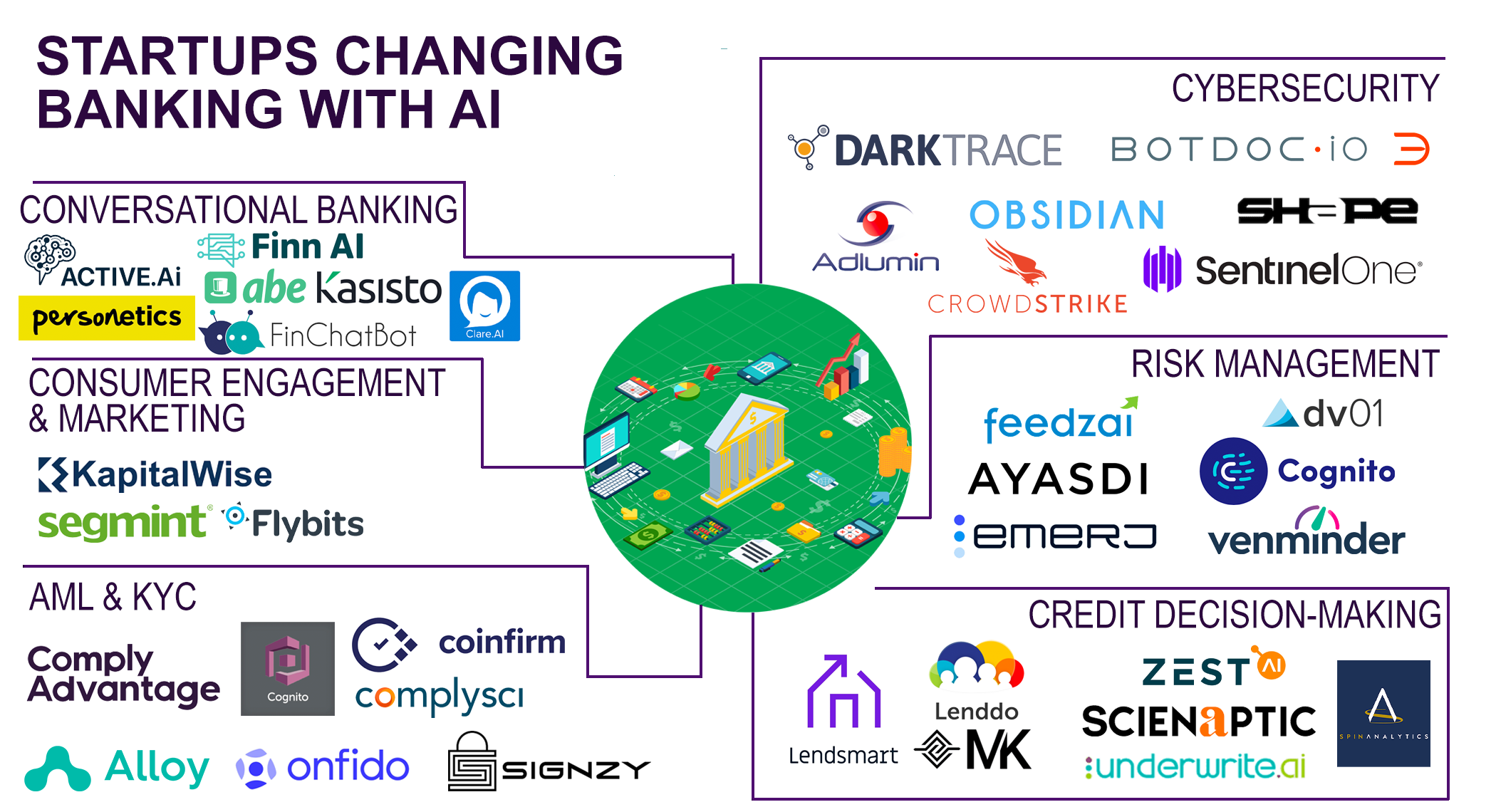

Predictive AI tools like Kapitalwise no-code platform provide financial institutions with comprehensive data on customer engagement workflows based on their financial transactions, credit history, and spending patterns. The behavioral analysis can be then used to predict the possibility of silent attrition to take preventative measures before it’s too late.

AI Chatbots for Churn Prevention

Marketers need to understand their customers’ financial journey and bank automation can help make this process easier. Kolsky concluded that customer churn can be reduced by 67% if companies succeed in solving customer issues during the first time interaction and successfully managing customer expectations. Algorithms help resolve simple customer queries that might have similar answers to questions framed differently. Deep learning happens over time making conversational AI capable of solving complex problems eventually without human intervention.

However, predicting attrition risk is not the complete solution to the problem. One of the major reasons why a customer goes silent is because they stopped seeing value in the service provided. Also, the queries they raise goes unaddressed. Customers are somewhat stuck in a state where they don’t leave their service providers nor are they willing to stay.

According to Forbes, customer acquisition costs 5 times more than retention of an existing one. Traditional marketing doesn’t aim at individual preferences and in such cases, so personalized targeting comes to the rescue.

KapitalWise automated customer engagement platform is designed for financial institutions to provide personalized services to their customers via marketing campaigns, hyper analytics, and automated digital onboarding. Besides just reaching customers/members, banks and credit unions can also upsell and cross-sell their services via integrated APIs.